20

JanuaryBest Gold IRA Companies 2023

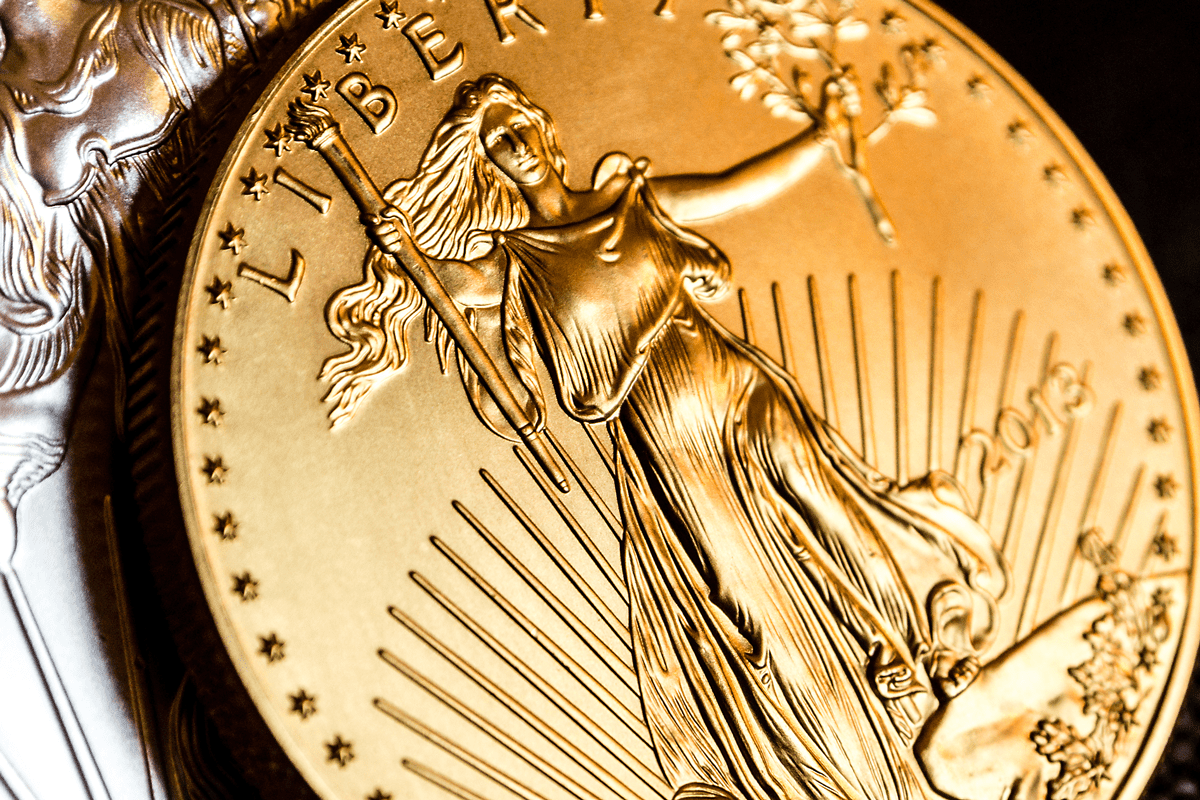

It’s important to do not forget that not all types of gold meet IRS requirements for inclusion in an individual retirement account; traders must examine with each their sellers and custodians concerning eligibility criteria prior to creating purchases. Gold is a solid selection as evidenced by the way traders flock to it, significantly in instances of financial uncertainty, when it often outperforms other investments. Widespread examples are first-time home prices, beneficiary funds, greater schooling charges and medical expenses higher than 7.5 % of your earnings. It is important to be aware of varied charges and prices when opening and sustaining a gold IRA, akin to custodian fees, storage charges, and insurance fees. If you cherished this informative article and also you would want to be given details relating to Getgoldinira.Com kindly pay a visit to the web-site. Their reps are high notch and spend a great deal of time making sure you perceive the product and are getting the method performed correctly. 5 stars score & high evaluations from BBB, BCA to Trustlink and others consumer websites. 1 gold firm by Inc. 5000’s checklist of American fastest growing personal compaines. For those who want to put money into valuable metals, they're the very best within the trade.

I do know MANY brokerages that cost 3%/ 12 months for their companies on stocks Can you buy insurance on your IRA stocks? There is nothing like holding a handful of gold bullion - it actually is a feeling like no different. Given the 60-day time restrict, anybody all in favour of a rollover ought to totally familiarize themselves with the particular processes and documentation mandatory from both the 403(b) plan supplier and the brand new IRA custodian to complete the switch. You need to pay a trustee to arrange the account, take possession of the gold, retailer and safe it, and ship reviews. Investors should also guarantee that each one paperwork required by the interior Revenue Service (IRS) is completed appropriately including filing Form 5498 which stories contributions made to IRAs during any given yr. Your tax filing form will permit you to point if any or the entire rollover must be thought-about non-taxable. You'll be able to both withdraw a examine from your 401k or ask for a direct rollover to your IRA through electronic means.

I do know MANY brokerages that cost 3%/ 12 months for their companies on stocks Can you buy insurance on your IRA stocks? There is nothing like holding a handful of gold bullion - it actually is a feeling like no different. Given the 60-day time restrict, anybody all in favour of a rollover ought to totally familiarize themselves with the particular processes and documentation mandatory from both the 403(b) plan supplier and the brand new IRA custodian to complete the switch. You need to pay a trustee to arrange the account, take possession of the gold, retailer and safe it, and ship reviews. Investors should also guarantee that each one paperwork required by the interior Revenue Service (IRS) is completed appropriately including filing Form 5498 which stories contributions made to IRAs during any given yr. Your tax filing form will permit you to point if any or the entire rollover must be thought-about non-taxable. You'll be able to both withdraw a examine from your 401k or ask for a direct rollover to your IRA through electronic means.

Goldco presents each gold and silver IRAs and allows rollovers from 401(k) and 403(b) plans, pensions, thrift savings plans and conventional and Roth IRAs. Learn our in depth Goldco overview here and learn extra about how Goldco can allow you to get started in securing your monetary future. Remember, the steps talked about above are normal pointers, and it’s essential to consult with a professional tax professional or financial advisor who can present personalized investment advice primarily based on your particular circumstances and the current tax laws and laws. If you're pondering of how to rollover your IRA or 401K in gold and silver bullion, right here is tips on how to get started, however, you will need to know that it will rely in your present scenario. Earlier than getting started, it is very important to inquire from your current 401(ok) provider if there's an possibility for an in-service distribution in its plan. If you do not know how you can get started, please do ask them to allow them to guide you through. One among the most important variations between bars and coins is that once you sell coins typically you will get a number of dollars over melt worth, or market value. They supply a free gold IRA guide, a gold IRA rollover calculator, and a team of knowledgeable experts. After all probably the most compelling purpose to roll your retirement plan into Gold IRAs is to diversify, and diversify your retirement savings.

Whereas most 401k to IRA rollovers are tax-exempt, the IRS might withhold 20 % of your rollover if you're taking a physical distribution slightly than transferring the funds electronically. Regardless of how a few years until retirement, it’s never too late to start planning and investing. Ultimately, it’s a personal determination that largely depends upon how you want to handle paying taxes on the funds. In this article, we’ll dive into understanding how valuable metals IRAs work, focus on components to think about when selecting the best gold IRA company, and information you thru the steps of opening a gold IRA account. Along with his on-line work, he has revealed five academic books for younger adults. The problems with that is twofold: with none excess earnings, these unemployed staff are left with no approach to sustain themselves or contribute to the financial system; in addition to this, these on authorities packages can usually contribute little again to this system in return for the government money granted.

Reviews